Forex traders have very suddenly tilted their collective focus towards interest rate differentials. Given that the Dollar is once again in a state of free fall, it seems the consensus is that the Fed will be the last among the majors to hike rates. As I’ll explain below, however, there are a number of reasons why this might not be the case.

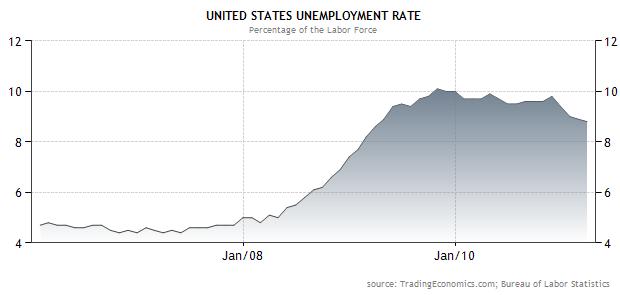

First of all, the economic recovery is gathering momentum. According to a Bloomberg News poll, “The US economy is forecast to expand at a 3.4 percent rate this quarter and 3.3 percent rate in the second quarter.” More importantly, the unemployment rate has finally begun to tick down, and recently touched an 18-month low. While it’s not clear whether this represents a bona fide increase in employment or merely job-hunting fatigue among the unemployed, it nonetheless will directly feed into the Fed’s decision-making process.

In fact, the Fed made such an observation in its March 15 FOMC monetary policy statement, though it prefaced this with a warning about the weak housing market. Similarly, it noted that a stronger economy combined with rising commodity prices could feed into inflation, but this too, it tempered with the dovish remark that “measures of underlying inflation continue to be somewhat low.” As such, it warned of “exceptionally low levels for the federal funds rate for an extended period.”

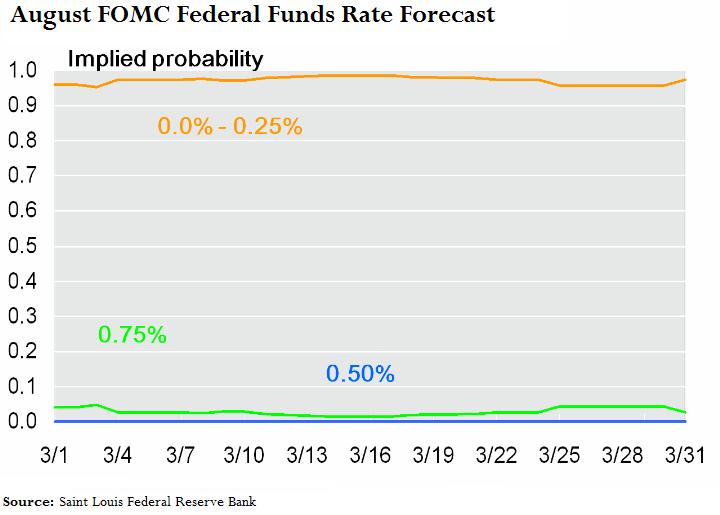

To be sure, interest rate futures reflect a 0% likelihood of any rate hikes in the next 6 months. In fact, there is a 33% chance that the Fed will hike before the end of the year, and only a 75% chance of a 25 basis point rise in January of 2012. On the other hand, some of the Fed Governors are starting to take more hawkish positions in the media about the prospect of rate hikes: “Minneapolis Federal Reserve President Narayana Kocherlakota said rates should rise by up to 75 basis points by year-end if core inflation and economic growth picked up as he expected.” Given that he is a voting member of the FOMC, this should not be written off as idle talk.

Meanwhile, Saint Louis Fed President James Bullard has urged the Fed to end its QE2 program, and he isn’t alone. “Philadelphia Fed President Charles Plosner and Richmond Fed President Jeffrey Lacker have also urged a review of the purchases in light of a strengthening economy and concern over future inflation.” While the FOMC voted in March to “maintain its existing policy of reinvesting principal payments from its securities holdings and…purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011,” it has yet to reiterate this position in light of these recent comments to the contrary, and investors have taken notice.

Assumptions will probably be revised further following tomorrow’s release of the minutes from the March meeting, though investors will probably have to wait until April 27 for any substantive developments. The FOMC statement from that meeting will be scrutinized closely for any subtle tweaks in wording.

Ultimately, the take-away from all of this is that this record period of easy money will soon come to an end. Whether this year or the next, the Fed is finally going to put some monetary muscle behind the Dollar.

Max CPC

Domains yahoo $97.44

Domain name yahoo $79.81

Dc hair laser removal washington $68.91

Law lemon wisconsin $66.15

Hair removal washington dc $51.14

Domain registration yahoo $41.97

Benchmark lending $40.36

Domain yahoo $38.05

Yahoo web hosting $37.86

Hair laser removal virginia $37.29

Peritoneal mesothelioma $36.59

Ca lemon law $36.55

Best buy gift card $34.13

Adverse credit remortgage $31.10

Mesothelioma information $30.98

Law lemon ohio $29.77

Att call conference $29.34

Insurance medical temporary $29.10

Illinois law lemon $28.95

Mesothelioma symptoms $28.78

Angeles drug los rehab $28.51

Personal injury solicitor $28.26

Att go $28.23

Accident car florida lawyer $28.03

Google affiliate $27.11

At t wireless $27.11

100 home equity loan $26.31

Mcsa boot camp $26.28

Anti spam appliance $26.19

Adverse remortgage $26.17

Chicago hair laser removal $26.00

Att conference $25.98

At and t $25.84

Laser hair removal maryland $25.45

Mesothelioma $25.15

Buy gift card $24.88

Mesotheloma $24.80

Student loan consolidation program $24.52

California law lemon $24.45

Event management security $24.30

Canada personals yahoo $24.15

Orlando criminal attorney $24.15

Uk homeowner loans $23.78

Vioxx lawsuit $23.71

Mesothelioma $23.65

Compare life assurance $23.55

Criminal defense federal lawyer $23.34

American singles $23.29

Federal criminal defense attorney $23.09

Laser hair removal manhattan $23.07

Att prepaid wireless $23.03

Fortis health insurance temporary $23.00

Miami personal injury lawyer $22.93

Hair removal chicago $22.75

At and t cell phones $22.74

Refinance with bad credit $22.61

Malignant mesothelioma $22.47

Lease management software $22.45

Primary pulmonary hypertension $22.34

Miami personal injury attorney $22.27

Anti spam lotus notes $22.24

Life insurance quotes $22.23

Egg credit $21.91

Anti spam exchange server $21.80

Lemon law $21.77

Google adsense $21.67

Best consolidation loan student $21.67

Refinance with poor credit $21.63

Employee leasing $21.49

Student loan consolidation center $21.36

Buyer mortgage note $21.35

Federal student loan consolidation $21.34

Symptoms of mesothelioma $21.33

City hair laser new removal york $21.31

Att wireless com $21.20

San diego dui lawyer $21.15

Indiana law lemon $21.14

Structured settlement $21.05

Law lemon michigan $21.10

Angeles criminal defense los $20.80

Refinancing with poor credit $20.80

Home equity loan $20.64

Action class lawsuit vioxx $20.64

Term life assurance $20.49

E loan $20.47

Celebrex lawyer $20.46

Vasectomy reversal $20.37

Mortgage rates refinancing $20.36

Attorney law lemon $20.28

Consolidate student loans $20.28

Home equity loans $20.17

Mesothilioma $20.11

New york personal injury lawyer $19.99

Home equity loan rates $19.98

Auto insurance quotes $19.97

Georgia law lemon $19.93

Homeowner loans $19.90

Equity loan rates $19.73

Administration lease software $19.68

Egg credit card $19.63

Student consolidation loans $19.58

Microsoft anti spam $19.55

Mesothelioma prognosis $19.41

Second mortgages $19.29

21 auto century insurance $19.26

Employee florida leasing $19.25

Federal consolidation loan $19.21

Equity loan $19.17

Personal injury attorney colorado $19.14

Accident lawyer michigan $19.03

Refinancing with bad credit $19.02

Home equity line of credit rates $19.02

Federal consolidation $19.01

Non profit debt consolidation $18.96

Pay per click affiliate $18.95

City hair new removal york $18.86

Acid reflux disease diet $18.85

Refinance poor credit $18.77

Equity loans $18.75

Student loan consolidate $18.73

Consolidate loans $18.60

Secured loans $18.51

Criminal lawyer new york $18.49

Affiliate per click $18.43

Chicago personal injury lawyer $18.29

Los angeles dui lawyer $18.29

Att prepaid $18.19

Angeles criminal defense lawyer los $18.10

Critical illness insurance life $18.04

Irs lawyer tax $18.03

Laser hair removal new york $18.03

Comcast high speed $18.02

Personal yahoo $17.98

San diego dui attorney $17.78

Michigan personal injury $17.77

Automobile law lemon $17.73

Cheap insurance life term $17.66

Home loans refinancing $17.52

Consolidate college loans $17.51

Cheap life insurance $17.45

Vioxx law suit $17.38

Student loan refinance $17.32

Car hire alicante spain $17.30

Tax attorney $17.28

Refinancing my home $17.28

Criminal dallas lawyer $17.24

Line of credit home equity $17.24

Litigation vioxx $17.23

At and t phones $17.20

Criminal defense attorney los angeles $17.15

Commodity online trading $17.14

Home equity rates $17.13

Adsense $17.12

Law lemon mass $17.12

Equity home $17.11

Arizona law lemon $17.10

Child molestation attorney $17.09

Home line of credit $17.09

Alicante car rental spain $17.06

Attorney defense federal $17.03

San diego criminal attorney $17.02

Injury lawyer new york $16.79

Attorney injury new personal york $16.78

At and t mobile $16.77

Pleural mesothelioma $16.72

Augmentation breast diego san $16.61

Home equity poor credit $16.61

Health insurance temporary $16.60

Compensation mesothelioma $16.60

21st century insurance $16.60

Cheap insurance medical $16.52

Angeles criminal lawyer los $16.51

Low cost term life insurance $16.49

Home refinance loans $16.48

Eloan $16.45

Life insurance quote $16.44

Cheap life assurance $16.39

125 equity loan $16.33

Anti spam exchange $16.32

Credit equity home line $16.31

Att go phone $16.30

Dui florida lawyer $16.30

Hair removal new york $16.27

Merchant account international $16.14

Vioxx class action $16.11

125 home equity loan $16.10

Life insurance quote online $16.10

Consolidation loan $16.09

Equity line of credit $16.04

Carolina law lemon north $16.02

Equity rates $16.02

Direct home insurance line $15.87

Angeles attorney los tax $15.86

Credit home line $15.85

Term insurance $15.81

Auto insurances $15.81

Debtfreedirect $15.80

Refinance comparison $15.80

Acid reflux treatment $15.77

Bad credit mortgage refinance $15.77

College loan refinance $15.73